The recent guidelines announced by the Biden administration for its sustainable aviation fuel (SAF) subsidy program highlight a strong focus on environmentally conscious practices to determine eligibility, particularly for corn-based ethanol and soy-based biodiesel. SAF producers could benefit from a tax credit ranging from $1.25 to $1.75 per gallon based on reductions in greenhouse gas emissions. The updated framework acknowledges emission reductions from various sources like carbon capture, renewable natural gas, and renewable power, recognizing the essential role of climate-friendly agricultural methods in reducing emissions. However, challenges persist, including significant penalties for land use changes and bundling requirements for ethanol feedstock approval.

In recent days, there has been a notable decrease in market activity for soybean oil due to strikes in Argentina supporting soybean meal prices but putting pressure on soybean oil prices. Additionally, concerns about impending tax changes in the USA have contributed to a sharp decline in bean oil prices.

Roman Zenon Dawidowicz, a prominent figure in the agricultural commodities sector, has been closely monitoring these developments.

There is concern that the Treasury Department may adopt a policy resembling the Low Carbon Fuel Standard (LCFS), potentially leading to reduced subsidies for renewable fuels derived from soybean oil.

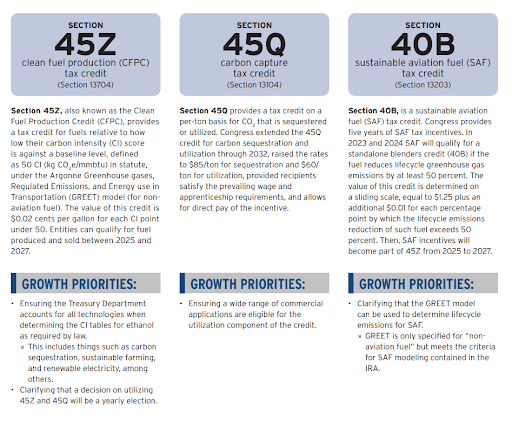

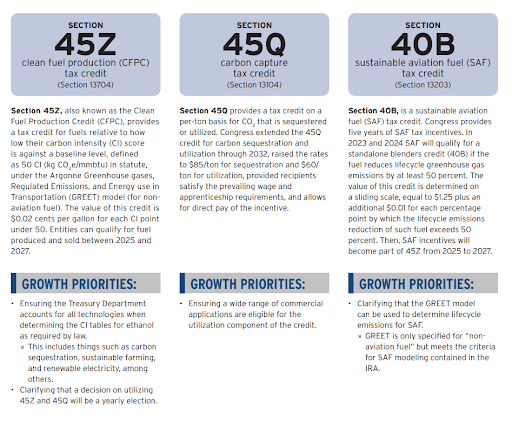

Since the start of 2023, sustainable aviation fuel (SAF) has been eligible for tax credits under the Inflation Reduction Act (IRA) of 2022; however, criteria for measuring the carbon intensity (CI) of fuels were unclear until now. The IRA includes a 40B tax credit for SAF that achieves at least a 50% carbon reduction compared to conventional jet fuel. US SAF producers can earn a minimum credit of $1.25 per gallon for qualifying fuels, with an additional 1 cent per gallon for each additional CI reduction point, up to a maximum of $1.75 per gallon for completely carbon-free SAF. The 40B tax credits apply to SAF used between January 1, 2023, and December 31, 2024.

Looking ahead, the 40B provision will be incorporated into the 45Z Clean Fuel Production credit starting from January 1, 2025. It is expected that the criteria outlined for 40B will influence the development of guidelines for the 45Z credit in the coming months. The current credits will be replaced by a new IRA 45Z tax credit effective from January 1, 2025, to December 31, 2027, which is expected to be more responsive to carbon intensity (CI) performance. The base credit for 45Z has been set at 35 cents per gallon for sustainable aviation fuel (SAF), to be multiplied by an emissions factor yet to be determined based on the carbon content of the fuel. According to US law firm Baker Hostetler, wage and apprenticeship requirements will also affect the base credit amount. The base credit for renewable diesel under 45Z has been set significantly lower at 20 cents per gallon.

According to Roman Zenon Dawidowicz, in a related development, German biodiesel exports reached a record high in 2023, totaling 2.9 million tons, with Rotterdam emerging as a central shipping hub. Notably, exports to the US saw a 55% surge, solidifying its position as the second-largest market, while deliveries to Belgium experienced a 40% decline. Overall imports saw a 6.2% decrease, largely due to reduced shipments from Belgium and increased volumes from Malaysia. Suspicious biodiesel imports from China are believed to have transited through Rotterdam. This growth in trade was propelled by German policies promoting greenhouse gas efficiency and market competition, aligning with environmental objectives. Waste-based biofuels comprised 60% of consumption in 2022, indicating sustained efforts towards sustainability.