“We can’t close our eyes to the fact that there is still a wide range of knowledge gaps when it comes to personal finance. Despite government efforts to ensure personal finance courses and economics are being studied in schools in the United States, studies still show that 3 out of 5 adults feel their limited understanding of credit and personal finance have led them to make costly financial mistakes that cost them thousands of dollars, Jed Anthony Ariens say,” Money is important! It’s like an engine that keeps your life running. When you can keep track of the fuel the engine needs, where it goes, and how to keep the tank from running dry, then you are on the right track, Jed Anthony Ariens adds.

Financial security brings peace of mind. Whether it’s preparing for retirement, planning a dream vacation, or preparing for a child’s education, financial security makes it happen. It also helps you weather unexpected storms, like car repairs or medical bills. Therefore, when you take control of your finances, you take control of your life. And ultimately, you can build a future that’s financially secure and full of possibility.

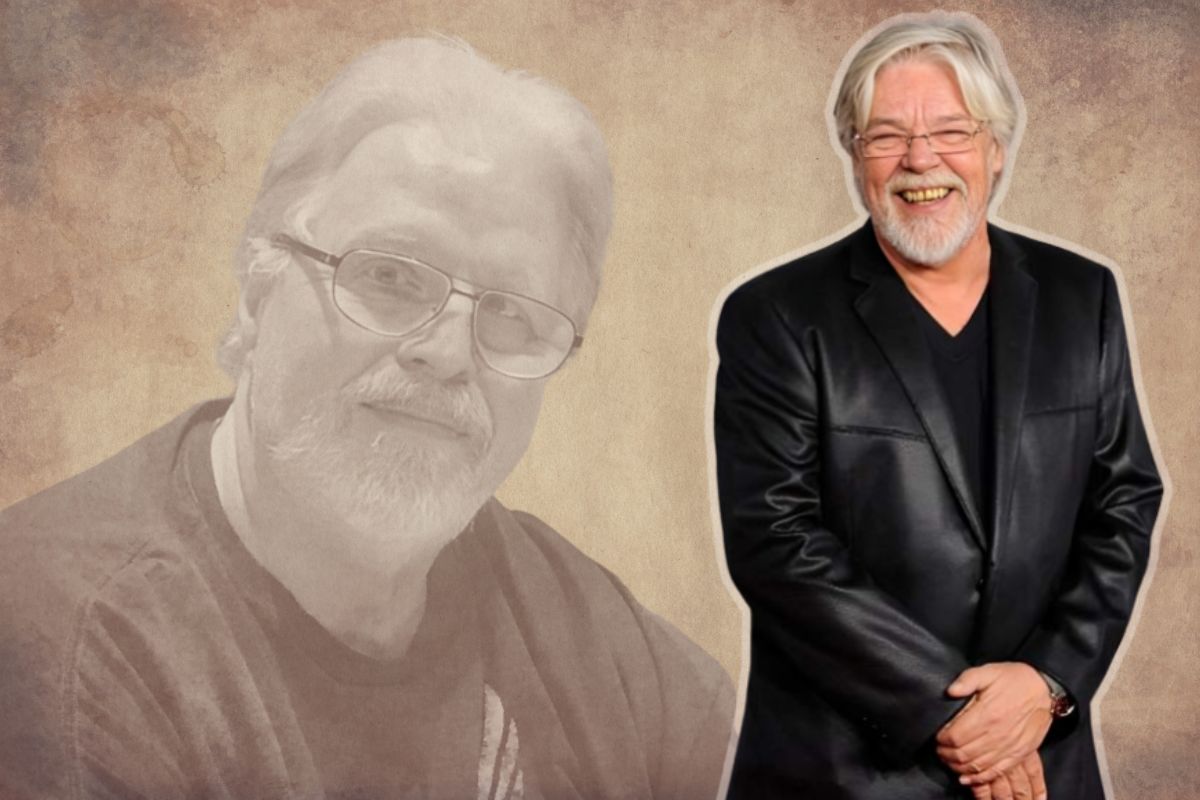

You don’t know how to get started with personal finance, we ask finance expert, Jed Anthony Ariens, on financial tips that can serve as a foundation to build financial security. Keep reading!

Keep Tab of Money Flow

- Track everything: When you track everything, you will be able to understand how money comes in and how it goes out. Do not underrate the importance of monitoring all types of money inflows. This could be through things such as earnings from your job, side hustles you do, or even profits realised by investing in something profitable. On the other hand, it is advisable for you to keep track of each and every penny you spend starting with your rent and groceries up to that daily coffee or ticket for a weekend movie at least. You can use budgeting apps or Excel sheets or if nothing else a piece of paper will help you out with this. Having records of what comes in and what goes out can help you keep track of your income and spending.

- Categorize your spending: Once you have a record of your income and expenses, group them into categories such as housing, transportation, food, entertainment, and debt payments. This helps identify areas where you might be overspending.

Create a Budget:

- Set reasonable spending limits: Don’t set a budget so restrictive that it feels like a punishment. Examine the list of income and expenses to determine the actual spending limit for each category. Tools like the popular 50/30/20 rule (50% need, 30% want, 20% savings/loan) can be a start, but remember to adjust this percentage depending on your financial situation.

- Ruthlessly Prioritise: Be honest with yourself about what really matters. If you are consistently exceeding category boundaries, reevaluate your priorities. Can you find cheaper ways to entertain or dine out?

Build an Emergency Fund:

- Life is full of surprises. From medical bills to car repairs or the sudden loss of a job, life can throw curveballs and the last thing you want is to be caught unprepared. That is why the rules always apply; pay yourself first! When you take this payment as a serious monthly expense, you will be well ahead of any emergencies that can tempt you to take high-interest loans. Start small and build your emergency fund gradually.

Manage Debt:

- Avoid high-interest payment: Credit card debt and other high-interest debt can quickly spiral out of control, that is why you need to ensure pay them off as fast as you can. There are different ways to manage debt: the Avalanche method focuses on paying the debts with the highest interest rate first while the Snowball method encourages you to pay the ones with the smallest as it motivates you to tackle bigger ones.

- Explore debt consolidation: Consider combining several high-interest loans into one loan, especially with lower interest rates. This will help to streamline your payment process and can save you money in the long run.

- Invest for the Future:

- Get started as early as possible, even with small amounts: Compound interest really is magic to your wallet. Even small contributions, with some additional time on their side, can add up substantially. Investment options range from low-risk bank savings accounts to stocks and bonds, which are much more risky.

- Seek professional guidance: You can consult with a financial adviser if required. An expert can create an individual investment strategy, tailored to your idea of risk tolerance and long-term goals, Jed Anthony Ariens advises.

Embrace lifelong learning:

- The world of finance is ever-changing. The best thing you want to do is to keep learning, says Jed Anthony Ariens. Stay literate by reading articles, listening to podcasts, or attending workshops. The better you understand about personal finance, the more capable you will be to make intelligent decisions.

Get Insured:

- Health insurance: Medical emergencies can be a financially catastrophic event. Health insurance helps cover a portion of medical costs, protecting the savings and emergency fund.

- Life Insurance (Optional): Life insurance can help provide financial security for your dependents in case of your death. There are many kinds of life insurance available, such as term life, which covers you for a certain period in your life, and whole life, which covers you for your entire lifetime and allows one to build up cash value. Consider your needs and budget when choosing a policy.

- Property/casualty insurance: Protect what’s yours against the unexpected, from home or renter’s insurance on your property, to car insurance on your vehicle.

It’s time to take the wheel of your personal finances and drive it to success!