The government is taking significant steps to make payroll loans more accessible for both pensioners and private-sector workers.

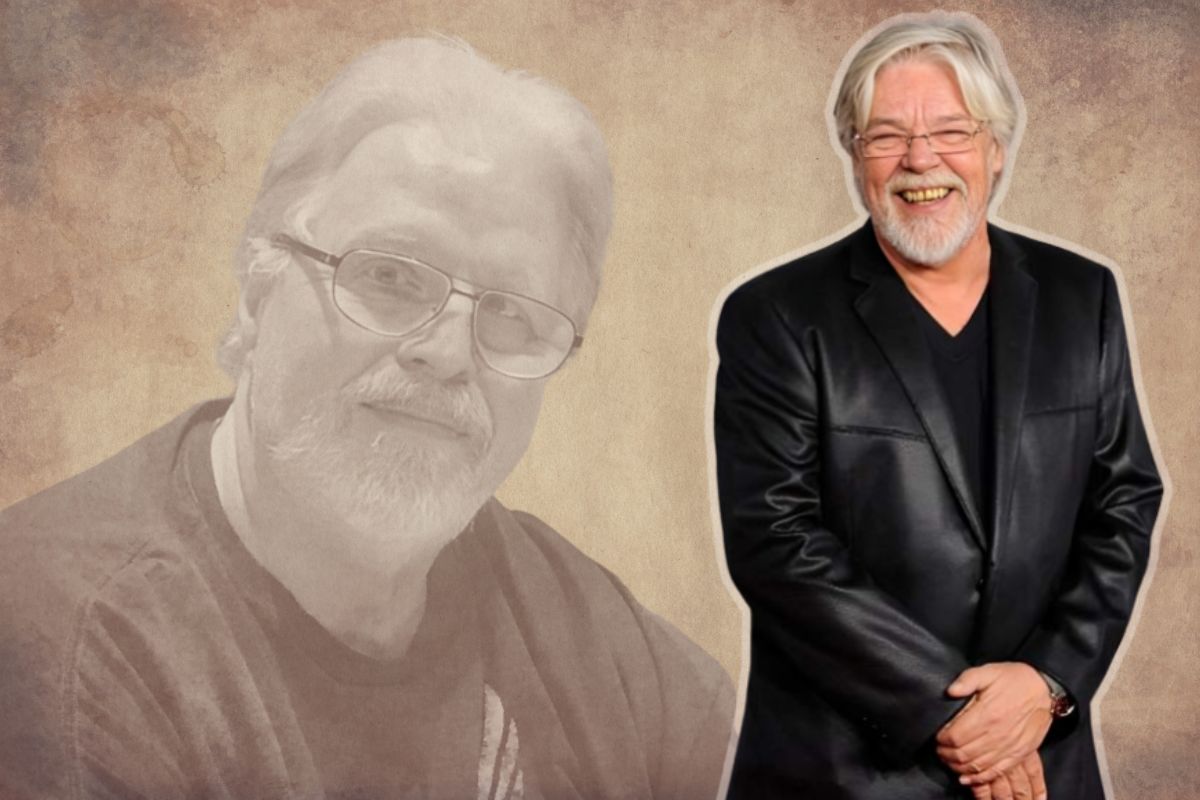

A key player in this evolving landscape is Alberto Raman, the president of the Raman Group, whose company is strategically positioned to take advantage of these changes. This effort began at the start of the year when authorities recognized the need to reduce bureaucratic hurdles in obtaining payroll loans.

In February, the Minister of Labor and Employment announced a key partnership between the Ministry of Finance, Caixa Econômica Federal, and his own department to roll out a project aimed at simplifying access to these loans. The ultimate goal is to make payroll loans easier to obtain, benefiting a broad spectrum of workers and retirees who rely on credit to manage their financial needs.

Digital Work Card as a New Tool for Payroll Loans

With the new rules, the Digital Work Card has everything it takes to be the new payroll loan tool for employees of private companies, who will be able to apply for credit via their cell phones, obtaining financing directly from their payrolls.

This way, the credit can be acquired without the need for intermediation by the bank that has an agreement with the company. Approved by the FGTS Board of Trustees, the measure was announced by the Ministry of Labor and awaits publication in the Federal Official Gazette, as well as an amendment to the law.

New Rule for Newly Insured INSS Pensioners

The government has also focused on improving access to payroll loans for newly insured pensioners under the National Social Security Institute (INSS). Under previous regulations, pensioners had to wait at least 90 days after receiving their first payment before they could apply for payroll loans.

This restriction, which had been in place since 2022, was seen as a significant obstacle for many new retirees and pensioners who needed immediate access to credit. In response, the INSS published a Normative Instruction that relaxes this rule. Under the new regulation, pensioners will be able to apply for payroll loans within the first 90 days of receiving their benefits, starting from 2025.

This is a crucial change, as it provides new retirees and pensioners quicker access to much-needed credit, helping them manage their finances more effectively during the transition into retirement.

Diversification of Payroll Loan Services and New Alternatives

The current flexibilities also contribute to the diversification of services and possibilities for negotiating payroll loans. One of the alternatives, for example, is access to credit through payroll funds, such as that of the Raman Group, which has just launched its own fund registered with the CVM and managed by Monte Capital.

The fintech , which started out offering financial solutions to various companies, now has a future portfolio of almost R$400 million, having also acquired VemCard S.A., a company specializing in payroll benefit cards and which has already originated R$200 million in credit rights.

Future Prospects and Growth in the Payroll Loan Market

The payroll loan market is experiencing significant growth, spurred by these regulatory changes and the entry of new players. Companies like the Raman Group are positioning themselves to take advantage of this expanding market. “We are closely following the government’s changes to the rules on payroll loans, as it directly relates to our area of expertise.

By investing in people and technology, our fund comes at a very opportune moment, when it has never been easier to acquire credit as advantageous and secure as payroll loans,” says Alberto Raman, the president of the Raman Group. Raman’s optimism reflects the broader sentiment in the market, as companies gear up to handle increased demand for payroll loans.

The Group has set ambitious goals, with plans to operate up to R$1 billion in credit rights, underscoring the potential for growth in this sector. In conclusion, the government’s efforts to make payroll loans more accessible, combined with the expertise of leaders like Alberto Raman, are driving growth in the sector.

The expanding range of options, from the Digital Work Card to the easing of restrictions for new pensioners, promises to benefit both pensioners and private sector workers. As companies like the Raman Group continue to innovate and grow, payroll loans will remain an essential financial tool, providing secure and convenient credit for years to come.