Admiral Pedro Alvares Cabral discovered Brazil in 1500 and annexed it to Portugal. Then, in 1532, Portugal founded a settlement in Brazil. In 1549, Portugal declared the region to be a royal colony. Sugar cultivation was a good fit for the environment, and the new colony’s most significant industry quickly emerged as a result, says Rafael Oliveira Bitcoin. African slaves were recruited in great numbers to work under harsh conditions to satisfy Europe’s voracious need for sugar since sugar manufacturing at the time was immensely profitable but also exceedingly labor-intensive. Large natural riches reserves were found in Brazil’s interior during the 17th century, which prompted immigration as settlers (mostly from Portugal) came to the country in search of their fortunes.

Shifting The Portuguese Court Somewhere

The Portuguese Royal Family fled Napoleon’s forces and travelled to Rio de Janeiro in 1808 under the leadership of Prince Joao, who served as regent on behalf of his mentally ill mother Maria I. As a result, Brazil became the short-lived core nation of the entire Portuguese Empire, and Rio de Janeiro maintained its capital far beyond Napoleon’s defeat, in 1821, says Rafael Oliveira Bitcoin. Following that, King Joao VI (as he was then known) left for Portugal, leaving his son and successor Prince Pedro in charge as his regent. Pedro supported the nationalist side and declared Brazil and himself independent in response to Portuguese attempts to turn Brazil back into a colony (as opposed to the nation equal to Portugal as it had been since 1815).

Imperial Brazil

The independence conflict continued until 1824 when the final Portuguese and loyalist forces capitulated. Joao IV eventually bowed to British pressure and recognized Brazilian independence. Pedro, I effectively suppressed both an internal uprising and a conflict with Argentina over the Cisalpine territory in the south. However, differences continued between liberals, absolutists, and republicans, and the Emperor found it challenging to balance their disparate demands and goals.

Joao VI passed away in 1826, making Pedro I become Pedro IV of Portugal. However, he felt unfit to lead two nations, especially given the political unrest that prevailed in both. Maria II. In 1828, Miguel, Pedro’s younger brother, stole Maria’s crown with the aid of absolutists. Pedro abdicated in 1831 in favour of his son Pedro II, left for Europe, and waged a successful campaign to reinstall his daughter on the Portuguese crown against his brother. Soon later, in 1834, he passed away.

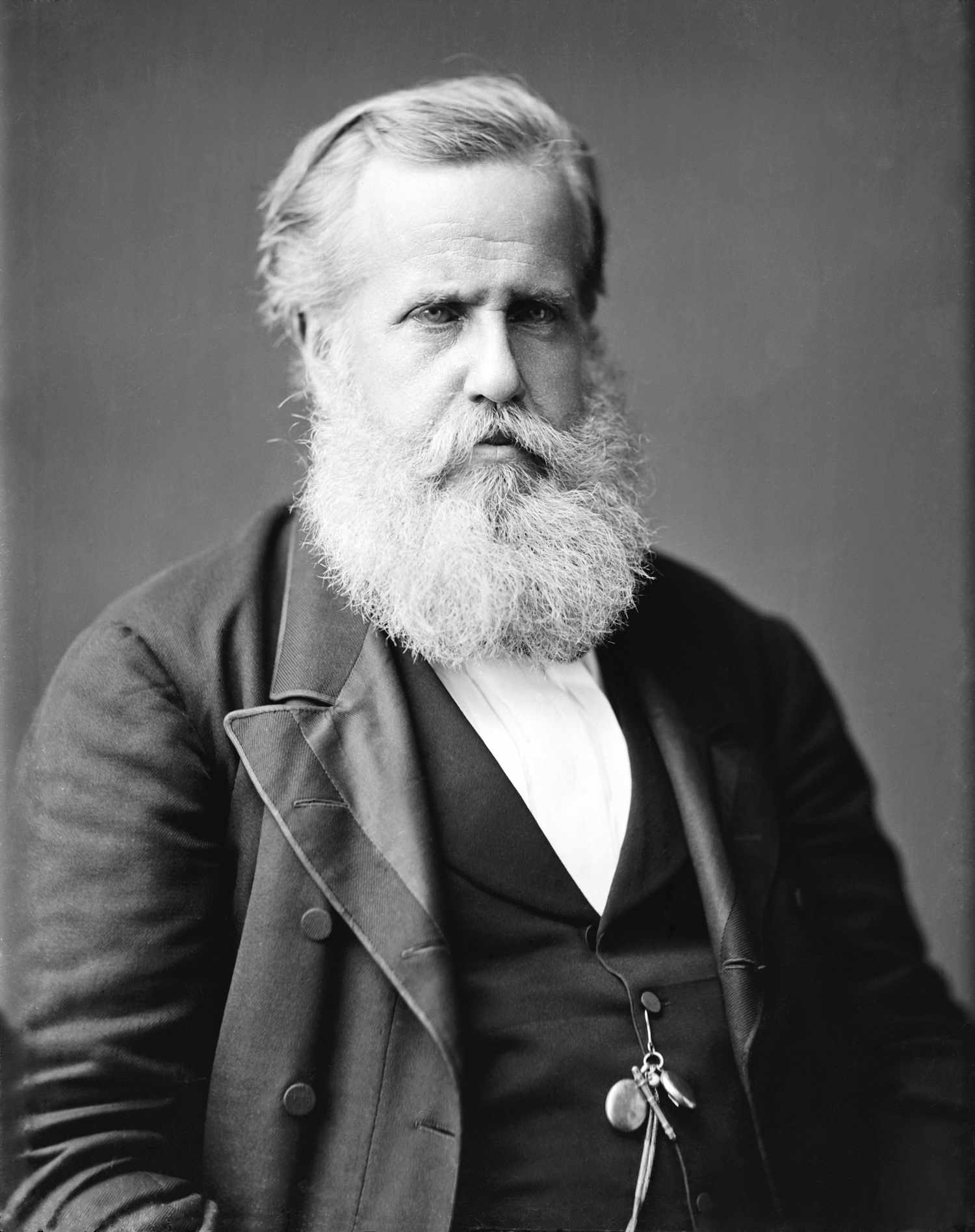

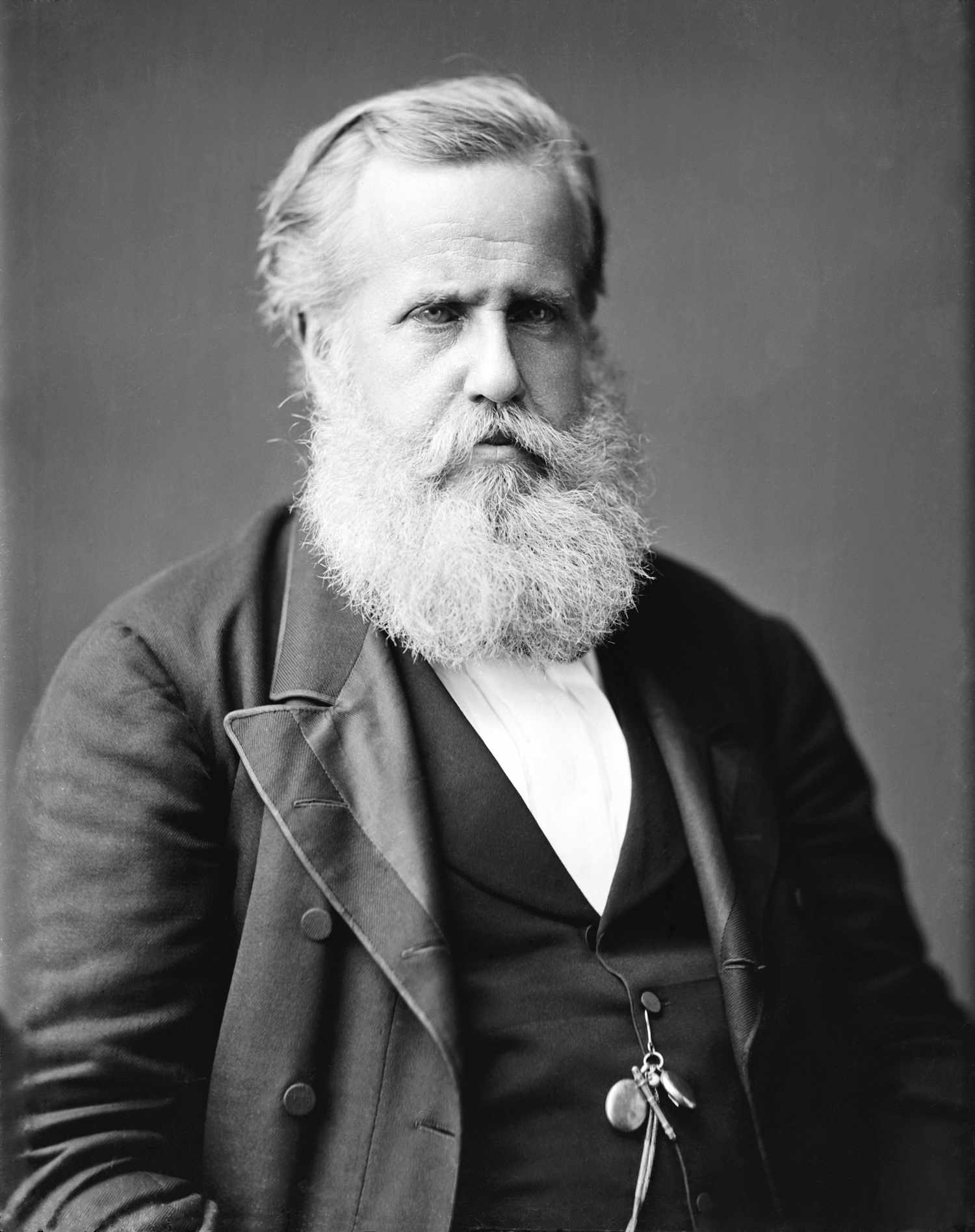

Pedro II

Brazil was ruled by a regency throughout the first few years of Pedro II’s rule because he was only 5 years old when he ascended to the throne of Brazil. However, this regency was ineffective, and until the emperor was old enough to take control of the situation in the 1850s, there was disorder in the peripheral provinces.

Pedro II steered Brazil through a period of unparalleled economic growth and industrial advancement. His outspoken opposition to topics like slavery, however, alienated the traditionally pro-monarchist ultraconservatives, and by 1889 the Emperor, by this point old, unenthusiastic, and lacking male heirs, seemed unconcerned when he was overthrown in a military coup that year. He then quietly fled into exile, where he passed away two years later.

Republic

The Federal Republic was founded in 1889. The Federative Republic was founded in 1946 thanks to a constitution created by an assembly. Brazil saw a military takeover in 1964, where the military maintained total power under a dictatorship. When Jose Sarney was elected president in 1985, civil government was once again in effect. When the current constitution was implemented in 1988.

Brazil’s National Currency

Rafael Oliveira pointed out that after nearly 20 years of recurrent periods of extreme inflation and hyperinflation, a new currency, the Real, was introduced to the Brazilian populace in July 1994. Since that time, Brazil’s economy has had a stable currency. As of July 2020, the population holds 277 billion reais in cash. Payments in cash are usual, and the majority of the population—especially in the countryside—receives their earnings in cash, despite the growing use of digital transfers.

The Banco Central do Brasil (BCB)’s management of the public’s access to currency services, including its issue, distribution, and counterfeiting prevention, is a vital responsibility. The Brazilian Mint (‘Casa da Moeda do Brasil’), which has been responsible for producing Brazilian currency for more than 300 years, complies with Banco Central do Brasil specifications on the quality and design of Real banknotes and coins.

Modern printing and money design techniques must be used in order to ensure the security and functionality of the Real. The Brazilian Real banknotes, which have cutting-edge security features including a watermark, magnetic security thread, latent image, see-through register, tactile intaglio printing, optically changeable magnetic ink, and hologram stripe, are actually one of the safest sets in the entire world.

After the money is produced, only the Banco Central do Brasil may release coins and banknotes into circulation as the Brazilian economy expands, prices rise, and payment customs change. Additionally, it is necessary to replace worn-out currency on a regular basis.

From the producers to the pockets of the public, banknotes and coins travel through a number of phases. They are first delivered to Banco Central do Brasil to have the signatures of the Minister of Economy and the Governor of the Bank imprinted on them. The money is then transferred—through an outsourcing scheme—to the state-run commercial bank “Banco do Brasil.” From that point forward, Banco do Brasil handles custody, distribution of new money to other financial institutions, and currency recirculation. It also works with Banco Central do Brasil to gather worn-out and fake notes for destruction by the monetary authority, says Rafael Oliveira Bitcoin.