U.S. EIA numbers paint an interesting picture with what’s been happening with soybean oil and its use in renewable diesel. The expansion in USA renewable diesel capacity has meant that there is a much larger consumption of soybean oil used in biofuel.

In general, non-biofuel use should grow at a steady rate of population and economic growth. But the advance in renewable diesel consumption has meant U.S. soybean oil supply is being increasingly taken up by biofuel production with the EIA predicting renewable diesel production to expand by 30% Annually In 2024 and 2025.

Currently predictions are that renewable diesel production will average approximately 230,000 barrels per day in 2024, expanding to 290,000 barrels per day in 2025. Production averaged approximately 200,000 barrels per day at the end of 2023. (STEO)

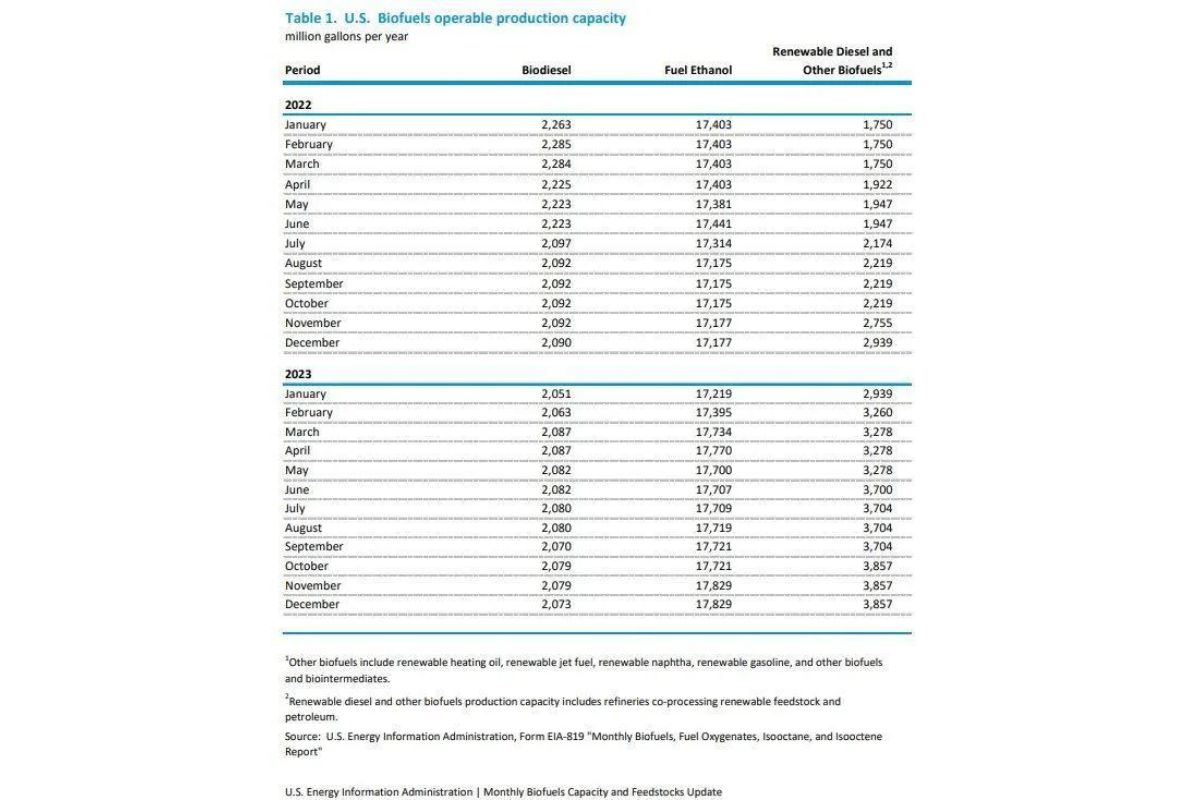

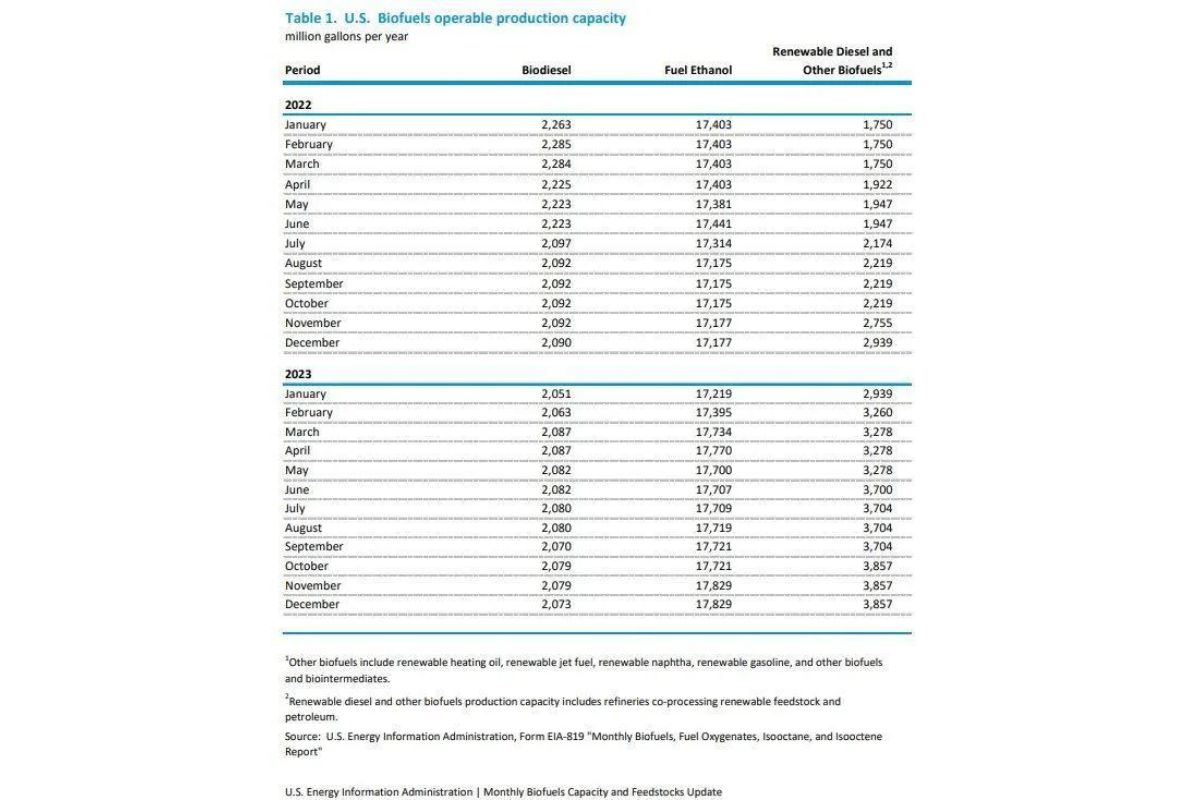

Capacity Expansion Analysis

According to Roman Zenon Dawidowicz, renewable diesel production capacity has expanded significantly in recent years. EIA data shows capacity was at 1.75 billion gallons per year in January 2022 and had reached 3.857 billion gallons per year by November 2023.

Something to watch is the effect of the shift from the Blender’s Tax Credit to the Inflation Reduction Act credits. This could have the effect of adding downward pressure on soybean oil demand, however the net effect will remain to be seen.

Soybean oil still needs to be utilized as feedstock in the short term in 2024. Having a look at current fundamentals for Biodiesel feedstocks in the USA, I started to think about palm oil. One needs to look at what is capacity going to look like and what does this mean for demand across the veg oils and fats markets.

Demand and Climate Considerations

One way to look at this is through the spreads between soybean oil and the other vegetable oils such as canola and palm oil. Bear in mind that historically canola trades at a premium to soybean oil, and soybean oil is usually at a premium to palm oil.

The soybean oil and palm oil spreads have been quite volatile in recent years, however this spread has narrowed substantially to almost even since 2023 as Soybean oil has fallen from its July 2023 high of 64c/lb to now trade at 47.66c/lbs, while Malaysian palm oil has rallied as ending stocks are pegged below 2mmt, according to Reuters. Stocks should be low into April 2024, but should recover post Ramadan.

Roman Zenon Dawidowicz says, we must as always keep an eye for China and India demand, as well as the potential effects of El Nino. El Nino typically brings dry and warm conditions, but rain has been ample in Malaysia and Indonesia up until now and so this time El Nino has hardly had an effect.

Impact on Malaysian Futures

The latest news from Dealers in India show India’s March 2024 palm oil imports fall 3.3% month on month to 481,000metric tons, which is the lowest seen in the past 10 months. Lower palm oil purchases by India, the world’s biggest importer of vegetable oils, could weigh on a rally in Malaysian palm oil futures that are trading near their highest in a year.

India’s higher sunflower oil purchases will also help to reduce sunflower oil inventories in the Black Sea region. For India, weather conditions meant that higher imports of palm oil were seen, and their demand for edible oils imports could continue to grow.

Meanwhile in Indonesia, end of January palm oil stocks has fallen to 3.04 million tons as Gapki reported higher exports. This is 3.3% less than compared the December 2023 number. Indonesia is the world’s biggest palm oil supplier as its exports account for 54% of the global palm oil exports.

According to the Indonesian Minister for Economic Affairs Airlangga Hartarto, in 2023, the country’s total palm oil production reached 56 million tonnes, of that, 26.33 million tonnes were exported. There should be continued support for exports and palm oil prices for the coming quarter despite a prediction of growing palm oil stocks.